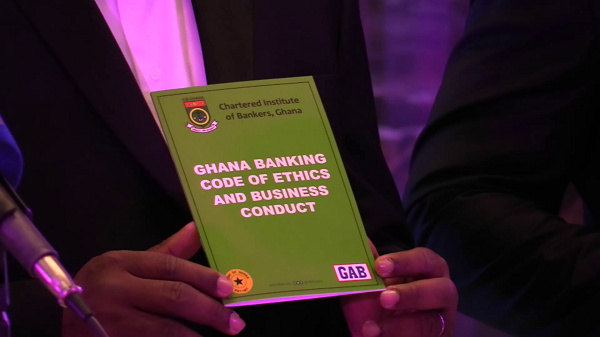

Ghana Banking Code of Ethics and Business Conduct Launched

The Chartered Institute of Bankers, Ghana (CIB) in collaboration with the Bank of Ghana (BoG) and the Ghana Association of Bankers (GAB) has launched the Ghana Banking Code of Ethics and Business Conduct.

This comes as part of efforts to curb the number of fraud-related cases perpetuated by staff within the banking industry.

President of the Chartered Institute of Bankers, Patricia Sappor launching the Code of Ethics explained it is intended to guide all practitioners to maintain the best banking practices and strong commitment to sound ethical and professional standards in the banking industry.

“This will ensure that Chartered Bankers continue to play critical roles in the banking industry and distinguish themselves on account of the significant contributions they make to the profession of banking as it is the only qualification customized to the core practice of banking,” Patricia Sappor said.

“The Code reinforces provisions made under Sections 18 (2) (d), 24 (1) (a) and the Third Schedule of Act 991. Thus, ensuring that all Financial Institution employees conduct their duties fairly, honestly and with integrity so as to uphold the mutual trust and public confidence bestowed upon them.” Sappor added.

“The effective implementation of the Code will foster a high level of integrity, discipline and etiquette in the banks leading to improved confidence amongst customers and the general public,” the CIB Ghana President stated.

The Code was developed by the Chartered Institute of Bankers Ghana in collaboration with the Ghana Bankers Association and the Bank of Ghana.

It is in line with Section 3 (d) of the Chartered Institute of Bankers Ghana Act, 2019 (Act 991) which reinforces the Institute’s mandate of setting standards and ensuring the observance of ethical standards and professional conduct among members of the banking profession in the country.

The Chartered Institute of Bankers, Ghana promotes the study of banking and regulates the practice of the banking profession in the country.

Meanwhile, the Bank of Ghana has expressed worry over the rising incidence of fraud committed by banks’ staff.

In its 2019 Banking Industry Fraud Report, the Central Bank stated that while the overall number of fraud cases went up marginally, those committed by banks’ staff remained dominant.

The report said the total number of cases reported was 2,295, with 1,667 of them committed by banks’ staff, either permanently employed or on contract.

source: ghanaweb